As the tax filing was concluded on 15th April 2025, most of the tax filers are awaiting for the Tax refunds. Tax refund is the money that is paid back by the Internal revenue service when the taxes are overpaid by the taxpayer or when the taxpayer is qualified for the refundable credits. Most taxpayers see their tax refunds are getting delayed and they don’t even know the reason for the delay. Let’s check the IRS Tax Refund Delay Update 2025.

IRS Tax Refund Delay Update 2025

The Internal Revenue Service offers a refund status checking tool. By using this tool the taxpayers can know their refund status. This tool can help to know the delay reason, if any. The IRS Tax Refund Delay Update 2025 will provide info on refund eligibility, timeline for the refund and delay reasons for the refund. Taxpayers have a 3 years timeline to claim the refund.

IRS.GOV Tax Refund Update 2025 – Highlights

| Post Title | IRS Tax Refund Delay Update 2025 |

| Year | 2025 |

| Country Name | United States |

| Update On | Tax Refunds |

| Who Provides? | Internal Revenue Agency |

| Who Gets? | Tax filers who have overpaid taxes or who qualified for tax credits |

| Tax Refund Timeline 2025 | Check this guide |

| Tax Filing Deadline | 15th April 2025 |

| Tax Refund Common Delays & Reasons 2025 | Incomplete Tax return, Errors on Tax return, SSN mismatch, filing late, filing paper return and more |

| Post Category | Finance |

| Official IRS Web Portal | www.irs.gov |

Who Can Get IRS Tax Refunds In 2025?

A refund is given to:

- Taxpayer who overpaid the taxes.

- Taxpayer who is qualified for the refundable tax credits.

To claim the refund, a tax return must be filed.

IRS.GOV Tax Refund Timeline 2025

The tax refund date depends on when the return is filed. The June 2025, tax refund dates are provided here:

| Tax Return Filing Date | E – Filing | Mail Filing |

| 1/05/2025 – 15/05/2025 | 22/05/2025 – 4/06/2025 | 29/05/2025 – 11/06/2025 |

| 16/05/2025 – 31/05/2025 | 6/06/2025 – 19/06/2025 | 13/06/2025 – 26/06/2025 |

Also Check with the General timeline to get the refund:

| Tax Return Filing Mode | Get Refund In |

| E – File Direct Deposit | 1 – 3 Weeks |

| Mail Direct Deposit | 3 Weeks |

| E – File Check | 1 Month |

| Mail Check | 2 Months |

Tax Refund Common Delays & Reasons 2025

- Filing of Incomplete Tax return: If a taxpayer files the incomplete return then refund can be delayed as the IRS does not have full access to the taxpayer information.

- Computation Errors: When filing a return, taxpayers need to fill in amounts of social security, care credits and more. If these amounts were given wrong then additional details may be required by the IRS and refund gets delayed.

- SSN Mismatch: If wrong SSN is provided then the return gets rejected and a new tax return filing is necessarily which may delay the refund.

- Filing return late: If taxpayers file the return late then the refund timeline will be more as IRS has a number of returns to process.

- Incorrect Direct Deposit Info: If the return is selected to be received via direct deposit then the taxpayer needs to provide the information related to bank details. If that is incorrect then the refund will be delayed.

- Filing Paper Return: Paper return processing takes time and due to this the refund will be delayed.

If you are also stressed out for the refund delay then these can be common reasons or to know your specific reason check the refund status via Refund Tool:

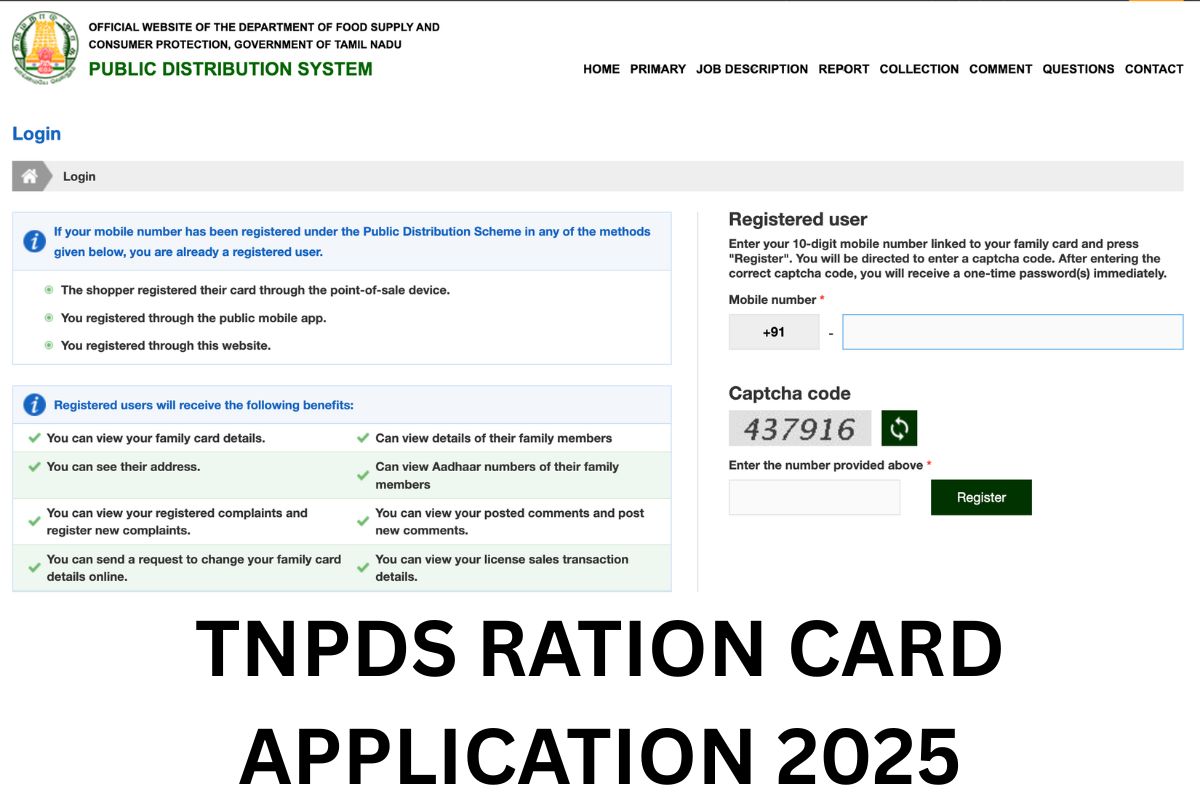

- Go on the IRS.gov portal.

- Look for the Refund Status option.

- Click on the Check Refund option.

- Enter SSN and select tax year like 2024, 2023 or 2022.

- Select Filing status like Single, Married but filing jointly, married but filing separately, head of household, qualifying widow/widower, surviving spouse.

- Enter the Refund amount as given on the tax return.

- Click Submit and check status and reason for delay.

FAQ Related To IRS Tax Refund Delay Update 2025

Taxpayers in the US who have overpaid the taxes or the taxpayers in the US who qualified for refundable tax credits can get tax refunds in 2025.

The tax refund issuance date is as per filing timeline and mode of tax filing.

The tax refund status can be checked via refund status checking tool provided on IRS.gov.

Tax refunds get delayed because of incomplete info on returns, paper filing, wrong direct deposit info, late filing of tax return, SSN mismatch, errors in social security taxes amounts or credits amounts.